Imagine: all of your financial goals are met, you are debt-free, your retirement is set and you have achieved financial freedom.

Sound impossible? It’s not.

You can meet your financial goals, IF you are willing to do the work in order to be financially free AND you believe that you can accomplish that goal.

My husband and I have paid off over $30,000 in debt during 2016, had a baby, budgeted successfully, put over $20,000 in a savings account, switched to one income and I was able to leave my job to take care of our newborn.

We have taken financial courses, sat down with financial advisors and have helped other couples budget as well.

BUDGET + FREE PRINTABLE, FOR BEGINNERS

Below are summarized, beginner tips from my experience. I am not a financial expert (and I want you to have the best options available), so I will point you to an AMAZING way to learn how to further understand and achieve your financial goals beyond the beginner level.

Your financial goals

Before you do anything, write out your financial goals. This is the why to tackling your finances. These goals will allow you to understand the reasoning behind the work you want to put in and taking this step is vital to the process. Do you want to be debt free, retire young, go on a vacation, or become financially independent? Write out what you would love to have and achieve, even if (right now) it sounds unfathomable to you.

Where to start

The absolute best place to start tackling your financial wellbeing is right where all the money goes: the source. If you know where every dollar goes, you can start paving your path. After all, if we are lost, we must first know where we are in order to navigate towards our destination. The starting point is creating a budget. This is the foundation of a path towards your financial goals.

“Budgeting is about making sure your money is being properly utilized for your financial goals.”

–Adam Hagerman, Budgeting For Haters

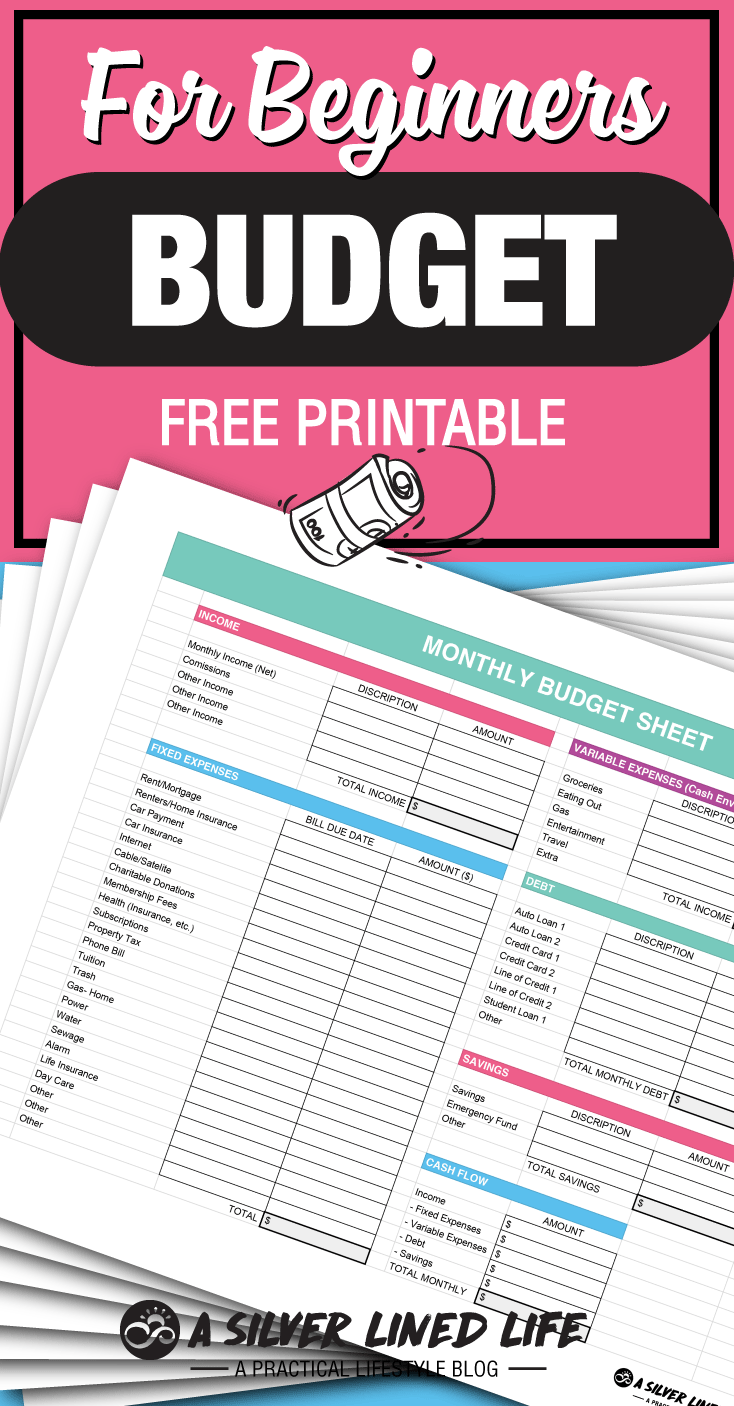

1. Download this FREE budget sheet & write out your fixed expenses

Set aside time to really get down to the nitty gritty of where all your spending goes in the fixed expenses column. After you have downloaded the worksheet, pull up your account information and fill in as many blanks as possible in the fixed expenses column. Next, fill out the income column. If you have a partner or someone who shares your expenses, you may want to make a coffee date of it.

2. Tackle your debt

A major step to financial well being is having zero debt. Debt ties you down and is a huge obstacle in the way of your financial goals. Many people could do so much with the money they put towards their financed life. What could you do with zero debt? For us, we were able to switch to one income and I came home to take care of our newborn.

When looking at your budget, fill out the debt column and take a look at the debt that has the highest interest rate or is causing the most discord in your life. Make it a priority to tackle this debt first. We went on Mint.com and input this into the goal setter. There, it calculates your interest, you can input how much you are able to pay extra each month and the calculator will show you when the debt will be paid off. This really helped us understand how every dollar would count and how we could achieve being debt free in an exciting and very tangible way!

3. Have a savings account goal

What does your savings look like? Build your savings account, even if you can only add $10 a month right now. We have an automatic transfer that takes money from our main account to our savings every month. This ensures that we are building a savings monthly. If you can penny-pinch even $10, it’s worth it to have some back-up. I would advise building your savings to at least three months of your income. But do what is comfortable for you or what is best for your circumstance.

Take a look at your fixed and variable income to determine what you can manage.

4. Estimate your variable expenses

While you are looking at your bank statement(s) from last month, total up what you spent. Subtract your fixed expenses. This is how much you spent on variable expenses. Some bank accounts will organize this spending for you into categories (though usually these are only guesses- many of the expenses may be categorized incorrectly). Mint.com does a great job pulling your account into categories. Start with categories you can easily manage. I advise:

-Gas

-Food

-Groceries

-Eating Out

-Extra

You can also have categories such as Beauty, Health, Medicine, Clothing etc. What you are looking for are categories that you can manage and track. This is where all of your spending will fall into.

5. Start cash envelopes

For us, cash envelopes are the bread and butter of our budget. A Gallup poll in 2013 said that only 32% of Americans have written out a budget. Even less stick to them! That’s a whole other ball game.

Decide how much you want to spend in each variable expense category (or how much you are able to spend) and on the first of each month (or when you get paid for the month), withdraw this total amount. Separate these into individual envelopes. You can divide each of these categories into a weekly budget and carry around only the week’s worth of cash for each category you know you’ll (probably) spend. This way, you know you aren’t spending too fast and you aren’t carrying around a month’s worth of cash.

Take a month to buckle down and then next month, on the first (or close to), take a look at your spending. Was the budget too hard? Too easy? Could you allocate more to savings, charities or other financial goals?

A final note

While I am not a financial expert, as I mentioned above, this is a basic overview of the system that has helped my husband and I pay off over $30,000 in debt, bring me home to take care of our new baby and be on the same page with our finances. This system is the first step towards financial well being.

But you know who is a financial expert? Adam Hagerman.

I have read Dave Ramsey’s stuff. I have taken courses in budgeting (along with Adam’s), helped others understand their finances, set goals and budget but Adam is an expert. He has a whole course called Budgeting For Haters where you can jump right in. While this blog post is a basic overview, this course gets down to the nitty gritty and helps you understand all facets of what taking control of your finances really means as well as the mindset- which is SO important. After this course, you will have a solid path in order to move forward towards your financial goals.

Here’s an excerpt from his course!

“First, I’m not just some guy who paid off his student loans and suddenly thinks he’s a financial expert. I’m a Certified Financial Planner professional and Accredited Financial Counselor dedicated to helping you achieve financial freedom. My education and career has been focused on personal finance education. I have a bachelors degree in finance, and a masters degree in personal financial planning. I’ve spent time in the financial planning industry as a licensed financial advisor and for the past several years, I’ve been a full-time financial coach where I’ve helped people just like you set financial goals, build a better budget, eliminate debt, save for retirement and much more.”

Did you know that retirement may not be what you think it is? Do you fully understand what financially freedom means and how you can obtain it? After Adam’s course, you will have the answers to these questions.

CHECK OUT: BUDGETING FOR HATERS

4 comments

Your blog looks terrific! So professional!

Laura Smith is one of my best friends, and she suggested I come see your blog.

Well done. I’ve been blogging for nearly ten years now. My blog is a personal blog.

I’ve wanted to do something more like what you’ve started, but haven’t found time

to figure it all out. It’s been a little daunting. I’d love to hear your insight.

God bless you and your family.

Please drop by and say hello!

ஐღLaura Laneღஐ

Harvest Lane Cottage

…doing what I can with what I’ve got where I am

on a short shoestring budget!

~~~~~

Hi Laura!

Thank you for the compliments! A monetized blog is definitely a time commitment. I carve out time at 5 am: a couple hours before our little one gets up. Then when she’s in bed and after dinner around 8 pm, I carve out a little bit more time. If you put your mind to it, you can do it!!! 😀 Totally hear you about the shoestring budget! We are there too for sure. I’ll definitely check out your blog!!

Great post! Your blog is absolutely beautiful and so well-branded. I’ve nominated you for the Blogger Recognition Award. Check it out: http://www.naturalbornmommy.com/blogger-recognition-award/

-Angela | Natural Born Mommy

Thank you, Angela!